Magic Money Trees

With talk of Universal Basic Income appearing to gain steam these days, one of the main objections is the sheer cost of the program. But one advocate of UBI claims to have the answer, and it lies in marrying UBI with its obvious philosophical twin: Modern Monetary Theory. In doing so, he manages to lay bare the utter nihilism behind both theories.

Okay, so you want to start your own country and create your own currency? Congratulations! What’s step one? …. Step one therefore is to create money out of nothing. Choose whatever you want. Want to use shells? Okay. Want to carve notches on rocks or sticks? Okay. Want to use dollar bills? Okay. Want to use ones and zeroes? Okay. Whatever you do, get that stuff to your people. After your people have money, tax some of it back. Don’t tax all of it back. That would leave nothing for them to use on goods and services in the private sector. Tax some percentage of it back. Congrats! You just ran a “deficit”, began your “national debt”, and gave your money value by requiring that people pay their taxes in your currency.

Cuckoo for Cocoa Puffs

Prediction Time

Jordan Peterson- The Liberals will be turfed out temporarily…

Strip Mining Investors

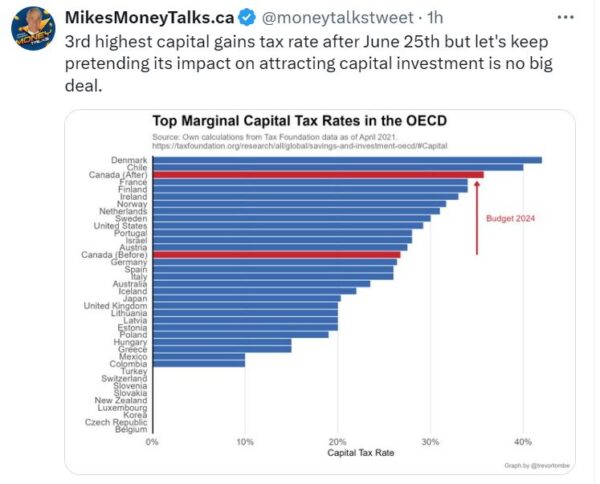

Perhaps the most drastic change in the recent federal budget is the hiking of the capital gains inclusion rate. This supporter of the change works out the math and finds that effectively treating a capital gain as wage income is just fine with him. The fact that an investor risks the loss of assets if the business fails is, to him, equivalent to the risk borne by the wage earner who gets paid every two weeks and never has to deal with the loss of a dime of capital to sustain the business.

Here’s the text of his X post:

$1 in wages. Top marginal tax rate = 53%.

Keep $0.47. $1 in corporate profit –> 26% corporate tax rate = $0.74 distributed as capital gains –> 50% inclusion rate = $0.37 taxed at 53% personal. All in, roughly 46% tax rate overall. Keep $0.54. Better than wages (and better than interest or dividends).

At 67% inclusion: roughly 52% tax overall for capital gains. So keep $0.48. Close to treatment of wages!

Sunny Ways…

Sun- Trudeau’s budget is a debt bomb

The Trudeau government’s 2024 budget is a tax-and-spend debt bomb financed by borrowed money and high taxation that is going to get worse year after year until the Liberals are booted from office.

Caught off guard by high interest rates, Finance Minister Chrystia Freeland delivered a budget on Tuesday awash in a sea of red ink, keeping the Liberals’ dubious record intact of failing to deliver a single balanced budget since they came to power in 2015, with no plan to balance the budget, ever.

And The Budget Will Balance Itself

WHEE! The Liberal Govt announces a $40B deficit with $50B in debt servicing costs, or $95K a second!

@RealAndyLeeShow is following the shitshow so I don’t have to.

Budget 2024 includes $411 million to support healthcare for asylum claimants and refugees, along with $79 million improve immigration holding centres and $141 million for lodging for asylum seekers.

Meanwhile, $8 million is dedicated towards preventing migrant smuggling.

CBC gets an additional $42 million taxpayer-funded bump in the budget.

It’s painful to listen to @cafreeland speak, but a necessary evil. Major capital gains tax increase pretends to be a wealth tax but actually will be imposed on any Cdns who have retirement savings & other investments. So most of us

“There are very few measures that are designed to increase capital investment and enhance labour productivity.” #cdnpoli #Budget2024 ~ Fred O’Riordan, economist

Hit me harder, daddy: … new controls and taxes on real estate to take effect in 2025. Measures to be detailed in “consultation” documents this summer include a tax on undeveloped property…

Tax and Spend. And spend and spend and spend.

I want a new country.

Pleasuring Themselves

On bridge blocking and other terribly radical acts:

Note the lofty defence offered by our pronoun-stipulating champion of the obstruction – that “protests are meant to be disruptive. It’s the whole point.”

A protest, then, is not meant to persuade the general public, or to get them on-side, or to make others sympathetic with whatever this week’s cause may be. But simply to be disruptive. To gratuitously frustrate, and aggravate, large numbers of law-abiding people. To exert power. By doing random harm. That’s “the whole point.” A vision doubtless attractive to those with antisocial inclinations.

And those inclinations aren’t being indulged and given rein reluctantly or under duress. The screwing-over of others is sought out and chosen, over and over again. This is recreational sociopathy.

When You Lose Bill Maher

Infinite Mortgages

The Bank of Canada’s efforts over the past year to hike interest rates are now at the point where you can call the policy utterly laughable, considering that whenever the policy threatens to have consequences, those consequences are speedily legislated out of existence. The government of Canada has just issued new mortgage measures whereby anyone who can’t pay their mortgage can simply make whatever payments they can afford. That’s a pretty sweet deal, if your goal is to turn homebuyers into blatant parasites.

…the government will allow 30-year mortgage amortizations for first-time home buyers purchasing newly built homes, effective August 1, 2024.

Third, the enhancements to the Canadian Mortgage Charter will also include an expectation that, where appropriate, permanent amortization relief will be made available to protect existing homeowners that meet specific eligibility criteria. Amortization relief means eligible homeowners can reduce their monthly mortgage payment to a number they can afford, for as long as they need to.

Socialist Progress

In the continuing saga of The Workers’ State of South Africa, there’s finally some good news. Well, sort of. It seems that there have been fewer power outages lately. Mind you, that’s not because supply is growing. Rather, shuttered factories have no need for electricity and the marginal consumer is simply going off-grid.

The weak South African economy, and the resulting generally flat overall demand for electricity.

Rapidly rising price of Eskom and municipal electricity of two to three times the inflation rate for many years, is dampening demand for Eskom generated electricity.

Load shedding and low reliability of Eskom and municipal grid electricity, particularly for the last four years, have been negatively impacting electricity supply.

Electricity customers are responding by moving to self-generation and alternative energy sources, including rooftop solar PV, battery energy storage, gas for cooking, solar hot water geysers, energy efficiency, and a general reduction in demand for grid electricity.

Woke Justice

Leaving The Left Coast

But not necessarily the left.

Calgary Herald- Why thousands of British Columbians are leaving for Alberta

StatCan estimates the number to be 37,650 in 2023 alone. For the first time since 2012, B.C. lost more people than it gained, and almost all of those who moved in the final quarter of 2023 flowed to Alberta — a break from a trend where people in the prairie province sought out the West Coast as a place to live after retirement.

BC Climate Scam

BC United Caucus- New documents confirm the NDP not only knew about 20 percent carbon tax kickbacks to high-paid government consultants, but it also signed off on them.

Business Intelligence for BC- B.C.’s opposition parties demand probe into alleged government grant kickbacks

The Orca- B.C. energy minister faces backlash, orders audit in wake of clean energy grant scandal

And He Invokes “Social Justice”

He’s “not inherently dangerous.” He just wants to molest little girls, you see, while pretending to be a woman.

Justin’s Woke Prison

When they get out at least they will use the correct pronouns when mugging you. Canada’s wokest prison.

Losses For The Masses

Maybe central planning didn’t work at this time, but trust us, it will work at some point in the future. The question remains, why do we even have such a bank in the first place?

The head of the Canada Infrastructure Bank defended $900,000 spent on a now-cancelled power line project, arguing the project will ultimately get built and the due diligence the bank did was entirely reasonable.

The bank agreed in 2021 to offer a $655-million loan to the project and spent $900,000 on due diligence involving lawyers and outside experts. The project has since been suspended and the original owner sold its interest to another company. The loan did not go through, but the $900,000 had already been spent.

Render Unto Caesar…

Fraser Institute- Canada’s Rising Personal Tax Rates and Falling Tax Competitiveness, 2024

Comparing the provinces with 51 US jurisdictions (includes all states and Washington DC) shows nine Canadian provinces occupying the list of the top 10 jurisdictions with the highest top combined marginal income tax rates, and all provinces are in the top 15.

Canadian provinces are similarly uncompetitive with US jurisdictions when comparing personal income tax rates at the CA$300,000, CA$150,000, CA$75,000, and CA$50,000 income thresholds.

Canada’s top combined statutory income tax rate is also uncompetitive compared to other industrialized countries. Out of 38 OECD countries, Canada’s top combined income tax rate ranks 5th highest.

Pharma Pressure?

Suneel Dhand is a British physician who has been openly critical of pandemic policy in many a YouTube video and now focuses his critical eye on another common medical issue: blood pressure.

“I believe it’s absolutely ludicrous that we would have this one size fits all approach to blood pressure [of ] 120 over 80.”

“Every passing year the guidance from the medical establishment gets more and more aggressive and on many levels this is a complete money grab…”

Taxing Measures

Boston is certainly not the first city to hit the wall of declining commercial property values, and it won’t be the last. The cheering was widespread when everyone worked from home during the pandemic, but now that many of those jobs have disappeared and downtowns are filling up with the homeless, there’s simply not enough commercial tenants left to fill the gap.

A recent report by the Boston Policy Institute found the city may lose $1.4 billion in tax revenue over the next five years due to empty office spaces. Boston could also face a recurring shortfall of about $500 million each year after that first half-decade, the report found.

In a sane world, the solution would be to cut spending and align it with revenue. But in the insane Keynesian universe, the “solution” is to tax the remaining commercial property owners even harder than they already are. I can’t imagine any negative consequences arising from that, can you?

The measure would give the city the flexibility to temporarily shift more of the property tax levy onto commercial and industrial property owners. If approved, new tax rates would only go into effect if commercial valuations come in low as expected, Wu said.