The future is bipartisan.

And How Was Your Year?

Full report at Unusual Whales;

This year, Democrats absolutely dominated their Republican counterparts.

Dems were up 31%, and Republicans 18%.

Meanwhile, the S&P500 itself was up 24%.

WTFTX?

The U.S. government is dropping six charges against crypto scammer Sam Bankman-Fried including campaign finance violations and conspiracy to commit bribery charges.

Making bribes with stolen money is fine as long as that money is going to U.S. politicians.

SBF donated $100 million during the 2022 midterms, pouring tens of millions into dark money groups with customers’ funds.Some of these groups were linked to Senate leaders including Mitch McConnell and Chuck Schumer.

h/t joe, marc in calgary

Down The Primrose Path

“War,” said British philosopher, mathematician and pacifist Bertrand Russell, “does not determine who is right — only who is left.”

Those words might be the perfect lens through which to view what probably lies ahead for Ukraine in the coming year as its troops dig in — and dig deep — along a front roughly 960 kilometres wide.

Beyond that front stretches a wasteland of occupied territory — the smoldering ruins of a months-long summer counteroffensive that fell short of allies’ hype and failed to dislodge the Russian Army from the 20 per cent of the country it occupies.

Behind it lies a war-weary population, growing domestic political anxiety and infighting, and international allies who have grown more capricious — even delinquent.

Oh, well – they’ll always have that ‘Vogue’ cover.

Related: Inertia and dementia

Gradually, Then Suddenly

“If we lose Texas, we lose everything.”

Ep. 25 Liberals like Karl Rove just tried to annihilate Texas Attorney General Ken Paxton. It didn't work. Paxton just joined us for his first interview since his acquittal. pic.twitter.com/SAJGNN5LXW

— Tucker Carlson (@TuckerCarlson) September 21, 2023

It’s Probably Nothing

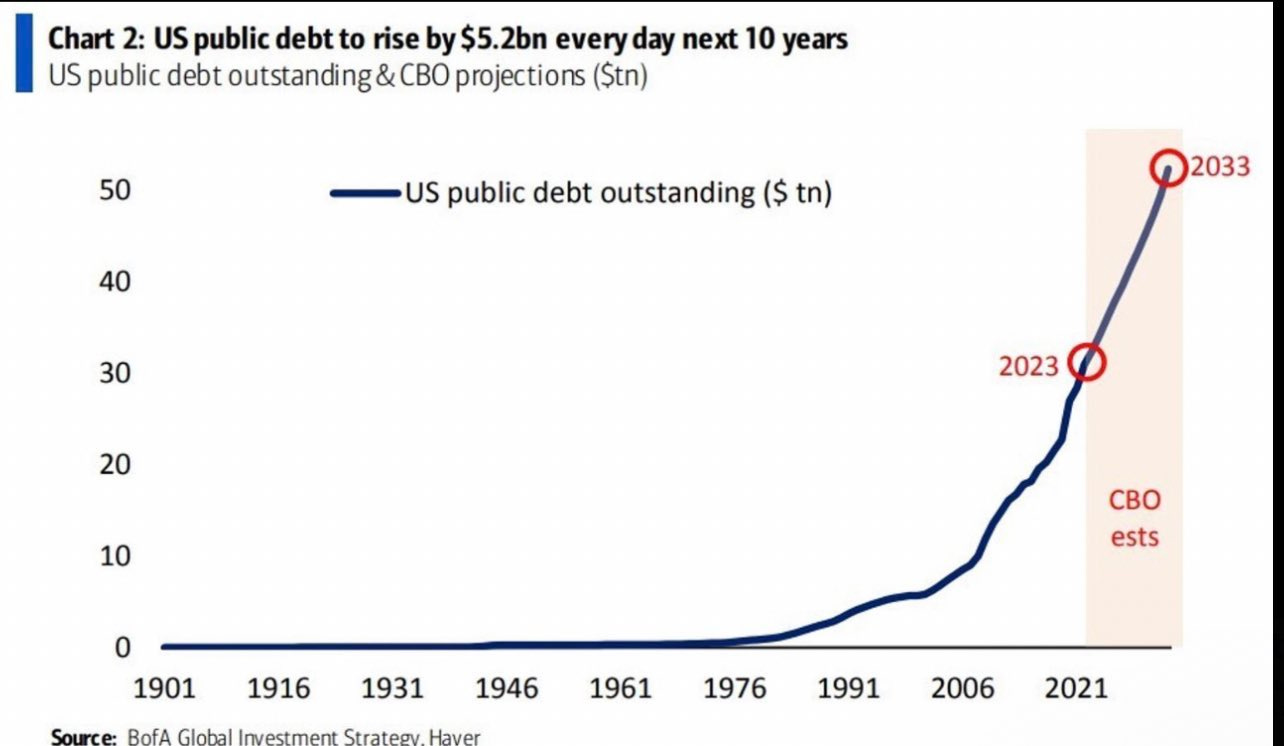

@zerohedge – Total US Debt surpasses $33 trillion for the first time. For those keeping tabs, the US added $1 trillion in debt in three (3) months.

Shoulda Mowed Your Own Lawns, America

They just can’t quit slave labour.

Longtime migrant workers are disgruntled with new waves of arrivals to New York City who they say are undercutting them — claiming anyone hiring them should “get the f—k out of here”.

City data shows over 116,000 migrants have flocked to the Big Apple since last spring and most are making ends meet working in the illegal underground economy — many while still living rent-free at taxpayer-funded hotels and shelters, as the New York Post exclusively revealed.

This poses a problem for more established migrants who have been working cash-in-hand for years.

They say newcomers accept next-to-nothing for work such as painting and concreting, driving down their own earning potential.

A tradesman known as “Parrow” who described himself as an “old timer” said he has been going to the Home Depot on Merrick Boulevard in Queens to pick up construction, plumbing and home improvement work for “20 plus years” but is now struggling.

The Deplorables

@tomgara – David Brooks is getting cooked on Facebook by an airport bar and grill, social media’s best days are still ahead

Via Ed Driscoll, who has plenty more.

Everything Is Fine

Fitch warns it may be forced to downgrade dozens of banks, including JPMorgan Chase

Slowly, Then Suddenly

Reuters:Moody’s cut credit ratings of several small to mid-sized U.S. banks on Monday and said it may downgrade some of the nation’s biggest lenders, warning that the sector’s credit strength will likely be tested by funding risks and weaker profitability.

Slowly, Then Suddenly

Fitch downgrades USA long-term credit rating to AA+ from AAA

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years

• Cites repeated debt limit standoffs and last-minute resolutions

• In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years

• We expect the general government deficit to rise to 6.3% of GDP in 2023, from 3.7% in 2022

• Fitch forecasts a GG deficit of 6.6% of GDP in 2024 and a further widening to 6.9% of GDP in 2025

• The interest-to-revenue ratio is expected to reach 10% by 2025 (compared to 2.8% for the ‘AA’ median and 1% for the ‘AAA’ median)This is huge and follows S&P downgrading the USA on August 5, 2011. The last episode sparked a major risk-off turn (and even got its own wikipedia page) and this one is likely to do the same, if not worse because now two-out-of-three of the US credit rating agencies have the US at sub-AAA.

Woman running world: Yellen “strongly disagrees” with Fitch’s decision

The Decline And Fall Of The American Empire

Yesterday, the US released their Budget Deficit Report.

To see how much interest the US has paid on Federal debt, you have to scroll to page 9 of the report. Then, go to the bottom of the table to the small line item below. Finally, you’ll see that the US has paid an alarming $652 BILLION in interest YTD, up 25% since last year.

As rates rise, we will soon see the first ever year with $1 TRILLION+ in annual interest expense. Interest expense will soon be the US government’s biggest expense, even more than social security.

The debt ceiling crisis wasn’t the real crisis.

It was simply a distraction.

Meanwhile, US tax receipts fell by nearly 10% over the same time period. The drop is the biggest since June 2020 when the US went into a full lockdown.

We have a spending problem and a revenue problem. A solution is needed.

Tucker Up, Buttercup (Bumped)

Clips are now making their way to Twitter, and some of them are lit. According to the comments, you can access the event via Blaze TV. I’ll post a few in the extended entry.

Update: You can find the video coverage here, still live, now into its 4th hour. Scroll the red time bar back for segments with the candidates.

**********

This is going to pull a lot of eyeballs.

One by one, Carlson will grill Florida Gov. Ron DeSantis, former Vice President Mike Pence, South Carolina Sen. Tim Scott, former U.N. Ambassador Nikki Haley, former Arkansas Gov. Asa Hutchinson, and businessman Vivek Ramaswamy.

Regardless of any private hesitation they may harbor, each of the campaigns who spoke with RCP ahead of the event say they take Carlson seriously. Most have spent considerable time preparing. And for good reason.

Build Back Better

U.S. has nearly one billion square feet of vacant office space: Visualized as a graph. Look out below.

Related: Wall Street Soothsayers Are Bewildered About What’s Next

Temporarily Unexpected

The fed has a major problem. It must let rates rise to meet some termination point, which means above the rate of inflation. But in so doing, it creates the conditions that lead to a genuine decline in the supply of money itself, which creates serious upheaval of an unpredictable sort. There is no winner in this game.

Keep in mind that this is happening even as price inflation is still intolerably high, with the Fed’s favorite measure (the Personal Consumption Expenditures index) hitting records for the year. That was not supposed to happen. This is called stagflation.

It strikes me as impossible that we can avoid a serious recession with such monetary shocks going on. To be sure, we’ve never seen anything like this in the postwar period—either the pumping in or the sucking out of money—so this could be wrong. We’ll see. But generally, starving the economy of that on which it has come to rely will topple lots of illusions.

Related: “Commercial real estate is melting down fast. Home values next,” the Tesla and SpaceX chief tweeted on Monday.

Margin Of Fraud

Pennsylvania has settled a federal election integrity lawsuit

.. saying that it has removed more than 178,000 ineligible voter registrations and promising greater transparency in its future housekeeping efforts.

As part of its settlement with conservative legal group Judicial Watch, Pennsylvania and several of its counties will publish information related to voter registration, including the total number of active voters; total number of inactive voters; and total number of voters removed from the voter rolls due to death, failure to respond to an address confirmation notice, and failure to vote in the two most recent federal general elections.

Biden won Pennsylvania by 80,555 votes.

Build Back Better

The experts are in charge, so relax.

The twin crashes in US commercial real estate and the US bond market have collided with $9 trillion uninsured deposits in the American banking system. Such deposits can vanish in an afternoon in the cyber age.

The second and third biggest bank failures in US history have followed in quick succession. The US Treasury and Federal Reserve would like us to believe that they are “idiosyncratic”. That is a dangerous evasion.

Almost half of America’s 4,800 banks are already burning through their capital buffers. They may not have to mark all losses to market under US accounting rules but that does not make them solvent. Somebody will take those losses.

“It’s spooky. Thousands of banks are underwater,” said Professor Amit Seru, a banking expert at Stanford University. “Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.”

The full shock of monetary tightening by the Fed has yet to hit. A great edifice of debt faces a refinancing cliff-edge over the next six quarters. Only then will we learn whether the US financial system can safely deflate the excess leverage induced by extreme monetary stimulus during the pandemic.

It costs $17,500 to insure $1 million of US debt against default for a year (the contract is actually priced in euros.) That’s up roughly 10-fold since the beginning of 2023, and compares to less than $400 for Germany, per Bloomberg.

— unusual_whales (@unusual_whales) May 4, 2023

The Decline And Fall Of The American Empire

Gradually, then suddenly.

The Decline And Fall Of The American Empire

Will BRICS challenge the dollar? pic.twitter.com/R8DBri3yyw

— Peter St Onge, Ph.D. (@profstonge) April 4, 2023