@KobeissiLetter: Dollar Tree stock, $DLTR, is down nearly 15% today after announcing 600-store closure and large earnings miss.

Garden Gnome Barbie

Crumbling Narratives

When I saw Peter Zeihan speak over a year ago, he openly derided the Russian war effort and confidently claimed that they were critically short of transport vehicles to even get troops to the front. A year later, it appears that the Ukrainians are the ones who seem to be running out of all sorts of stuff.

The Russian advances come in the face of a deep crisis in munitions for the Ukrainian military, creating a near-existential debate for frontline troops who must ration ammunition and are questioning how long they can withstand Russian pressure.

In another sign of the mounting sense of unease, the new commander of the Ukrainian military, Col. Gen. Oleksandr Syrskyi, twice in the past week scolded his subordinate officers for poor performance on this key front line.

On Thursday, Syrskyi criticised “certain shortcomings” and “miscalculations” by commanders on the Avdiivka front lines “which directly affected the sustainability of defence in certain areas.”

Fire Sale!

If a privately run pension fund made these kinds of investment blunders, it probably wouldn’t be long for this world. But if the state pension does it, presumably they can just up the contributions from their captive audience.

Canada Pension Plan Investment Board has done three deals at discounted prices, selling its interests in a pair of Vancouver towers, a business park in Southern California and a redevelopment project in Manhattan, with the New York stake offloaded for the eyebrow-raising price of just US$1.

Around the same time, CPPIB sold its 45 per cent stake in Santa Monica Business Park, which the fund also owned with Boston Properties, for US$38 million. That’s a discount of almost 75 per cent to what CPPIB paid for its share of the property in 2018.

Oh?

Telegraph- The economic case for mass migration has finally collapsed

Rather than turbocharging growth, immigration is placing near-unbearable pressure on public services, housing and infrastructure

Telegraph- Rishi Sunak demands 80 extra police patrols a week in ‘hotspots’

Don’t Worry, It’s Transitory

Sucky Systems

Interesting conversation. A little slow, but covers a lot of ground. Your mileage my vary. Grab a beverage.

Another Zero Percent Interest Miracle!

The most likely “solution” to an eviction crisis will be to either prohibit them entirely, thereby throttling rental supply even more, or slashing interest rates which will cause real estate values to soar even higher. The world’s economy is clearly between a rock and a hard place.

City marshals carried out 12,000 evictions last year, with 550,000 eviction cases filed since 2019. These numbers are reminiscent of evicting entire populations of mid-sized cities. The cause? A vicious cycle of increased living costs, including food, utilities, and healthcare, outpacing incomes and making rent unaffordable for many.

A Dragon No More?

After the death of Mao, China’s embrace of free markets sparked one of the largest economic booms the 20th century has ever seen. But is China now in regress as the communist party tries to widen its control over the economy?

Xi expects business as well as people to serve the CCP. As authoritarian controls metastasize throughout the economy, everyone suffers. For instance, even foreign enterprises now must accommodate party cells. The Wall Street Journal’s Lingling Wei reported on a Chinese “official, one of several who had helped introduce Western-style stock trading to China,” who cited “a worrisome trend of the party inserting itself more into companies’ affairs by pressuring them to accept Communist Party committees in their offices. ‘The whole thing about getting listed companies to set up party committees,’ he said, ‘is a reversal of what we had tried to do’.”

Sewage, Sewage Everywhere…

What do you get when voters elect a party whose philosophy is based on nationalizing the mines, banks and monopoly industry? Not prosperity, that’s for sure. It looks like the only rainbows in the Rainbow Nation will be the ones you see in a river of sewage.

Mortgage Blues

It’s rather stunning how rich some homeowners thought they were when interest rates crashed to near zero and the real estate market began to soar. Today, though, at least a few of them don’t feel so rich anymore.

I have two questions: Firstly, why did the bank approve this inflated mortgage in the first place? Secondly, how many more like this were also approved?

At the time, the property was listed for $465,000, but Hartmann says she paid $200,000 over the asking price.

“It was quite ludicrous, there were bidding wars and it was just really stressful,” said Hartmann.

But just seven months later, she was laid off from her well-paying job at Microsoft and at the same time, soaring interest rates nearly doubled her mortgage.

Hartmann said she tried to sell her house through two different realtors and ended up handing the keys over to Scotiabank in November.

Y2Kyoto: Coming Soon To A Canada Near You

Robert Bryce: The Deindustrialization Of Europe In Five Charts

Germany is once again, the “sick man of Europe.” But it’s not just Germany. All across Europe, industrial capacity is shrinking. Last month, Tata Steel announced it would close its last two blast furnaces in Britain by the end of this year, a move that will result “in the loss of up to 2,800 jobs at its Port Talbot steelworks in Wales.”

In January 2023, Slovalco announced it was permanently closing its aluminum smelters in Slovakia after 70 years of operation. The company, Slovakia’s biggest electricity consumer, said it was shuttering its smelters due to high power costs.

Europe drove itself into the ditch. Bad policy decisions, including net-zero delusions, the headlong rush to alt-energy, aggressive decarbonization mandates, and the strategic blunder of relying on Russian natural gas that’s no longer available, are driving the deindustrialization. How bad is it? Mario Loyola, a research fellow at the Heritage Foundation, wrote a sharp January 28 article in The Hill about Europe’s meltdown. According to European Commission data, industrial output in Europe “plummeted 5.8% in the 12 months ending November 2023,” he wrote. “Capital goods production was down nearly 8.7%. Investment in plants and equipment has plummeted.”

The result of all that lousy policy: staggering increases in electricity prices. Loyola notes that European electricity prices “have settled at triple their pre-pandemic levels.” Energy analyst Rupert Darwall recently reported that large businesses in Britain now pay up to five times more for juice than in 2004.

Gradually, Then Suddenly

‘most predictable crisis’ in history…

… the U.S. economy is resting atop a public debt exceeding $34 trillion, with its debt-to-GDP ratio sitting at around 120%. Perhaps not the blessing the Founding Fathers had once envisioned.

Now, alarm bells are beginning to ring with increasing frequency and volume.

Jamie Dimon says Washington is facing a global market “rebellion” because of the tab it is racking up, while Bank of America CEO Brian Moynihan believes it’s time to stop admiring the problem and instead do something about it.

Elsewhere The Black Swan author Nassim Taleb says the economy is in a “death spiral”, while Fed chairman Jerome Powell says it’s past time to have an “adult conversation” about fiscal responsibility.

And despite the issue being the “most predictable crisis we’ve ever had” according to former Speaker of the House Paul Ryan—a summary Dimon agrees with—it’s an item that isn’t yet top of the political agenda.

Zerohedge: Household Debt Tops $17.5 Trillion

A Dying Industry

If the insanity doesn’t stop soon, there won’t be anyone producing automobiles of any type.

Not to put too fine a point on the state of the EV market, but Ford is losing $38,000 per EV. This means the more EVs they sell, the poorer the company gets. They made $10 billion dollars in profits last year, yet the balance sheet shows they lost about $5 billion just on EVs. This puts them in the bizarre position that they could theoretically give away the entire EV production line and boost company profits by 50%. It’s that bad…

Indeed it’s so truly awful, that the UK Lords are calling for the government to counter the misinformation campaign filled with “mistruths”. The industry must be at deaths door.

Missing And Misappropriated Aboriginal Money?

If your reserve was sitting on substantial oil and gas deposits you’d have to have pretty lousy management to lose track of $120 million, but accountability is probably an outdated artifact of the colonial mindset anyway.

Public financial reports for Frog Lake First Nation show the band is short $120 million in net assets over a five-year time period between 2013 and 2018.

The records show the band-owned business called Frog Lake Energy Resources has been losing millions of dollars since 2015.

APTN reached out the current Chief Greg Desjarlais and initially agreed to an interview but later cancelled.

In a virtual meeting with community members he says that an audit is unnecessary.

Where’s The Beef?

Times- Vegan restaurant starts serving meat in bid to keep afloat

Plant-based restaurants are putting meat back on the menu as a growing number of Britons are turning off tofu and leaving behind the Veganuary trend.

In the latest sign that plant-based dining is in decline, a vegan restaurant in Cheshire has been forced to introduce meat options to prevent customers from walking out.

What Happened To All My Free Stuff?

No doubt all the Keynesian court economists will tell us that the solution to this problem would be to forgive the loans in their entirety.

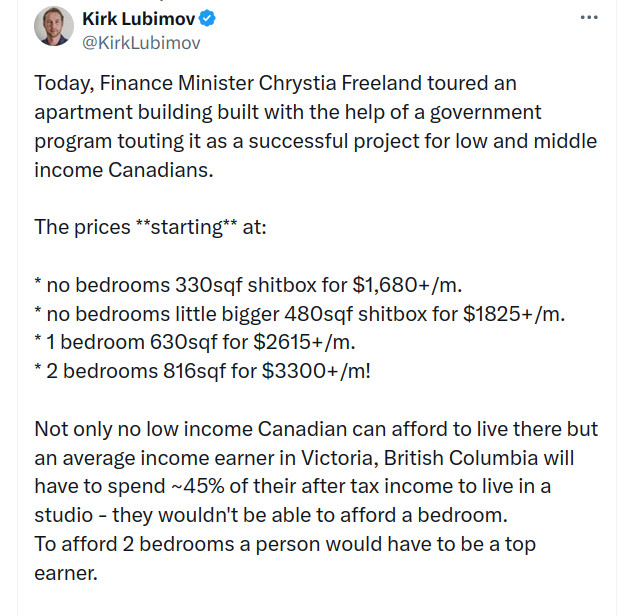

Last month, small businesses faced a deadline to repay interest-free loans of C$60,000 ($44,676) made available to each of them during the pandemic. Of the 900,000 who had taken the government support, a fifth have not yet repaid their loans, Finance Minister Chrystia Freeland said on Monday.

It’s Probably Nothing

Mortgage Market Blowup?

I’ve been expecting an implosion in the mortgage market for some time given the rise in interest rates relative to the debt that has to be supported, but so far that isn’t happening. It seems our friend Ron Butler has become privy to information that indicates a black swan event may not be far off, however.

Mortgage Investment Fund Blowing Up Soon: What Investors Need To Know About Mortgage Related Funds

We will read about a multi-million dollar Mortgage & Promissory Note Fund blowing up in the coming days & weeks

I will let big media with lots of lawyers name names

2/

— Ron Butler (@ronmortgageguy) January 30, 2024

Don’t Worry, It’s Transitory

The workforce reductions will save the company about $1 billion in costs, CEO Carol Tomé said on a company earnings call.

“2023 was a unique, and quite candidly, difficult and disappointing year. We experienced declines in volume, revenue and operating profits and all three of our business segments,” Tomé said.

Shares of the package giant dipped nearly 6% in premarket trading.

Bidenomics: Last week, in a campaign stop at a Pennsylvania coffee shop, President Biden seemed shocked at the $6.00 price of his smoothie.