National Post- Trudeau to Canada — starve your kids for climate change

I’m Not Eating Bugs

London Free Press- London cricket plant cuts two-thirds of workforce amid cash-flow crunch

Aspire Foods announced the jobs cuts Wednesday. About 50 workers remain at the plant in southeast London that opened in 2022 and received $8.5 million in federal government funding.

“It has been challenging. The company was ramping up but it became clear we needed to improve yields and we did not have cost structure” to improve production while keeping workers on site, he said.

“The mechanical systems were challenged, they were overloaded harvesting. We had crickets everywhere.”

Great Success!

Blacklock’s- Owe $1.76 For Each $1 Earned

Household debt in Canada is nearly $3 trillion, more than the value of all economic production nationwide, Statistics Canada said yesterday. The cost of credit fees and charges alone was costing billions, a StatsCan analyst told the Commons industry committee.

“By 2024, in August, household debt had reached nearly $3 trillion though the relative debt level slightly decreased to $1.76 for every dollar of disposable income reflecting higher income growth,” said Withington.

Diversity Is Our Strength

Immigration Minister Marc Miller’s department in an internal report admits it took no steps to determine if foreign workers took Canadian jobs or kept wages low. “Impacts are not monitored,” said the report: “The program is less aligned with commitments to consider Canadian workers first.”

Canada needs mass immigration because a growing population is essential for a healthy economy. (link fixed!)

They Vote Republican, Don’t They?

Lockland is a town of 3,400 residents.

3,000+ migrants from Mauritania were imported to the town in the past year.

Now town resources are collapsing. pic.twitter.com/PyVyNRQBKx

— End Wokeness (@EndWokeness) October 27, 2024

Fortunately for their cats, Mauritanians are Muslim.

War On Meat

By 2050, Britain will be a Muslim nation, so good luck with that, buddy.

Britain must cut its meat and dairy consumption by up to 50pc to meet the latest net zero targets, the Government’s climate watchdog has said.

The Climate Change Committee said in an ideal scenario, meat and dairy consumption should halve by 2050 and products be substituted with plant-based options.

The proposals are part of new net zero targets that have been recommended to Ed Miliband, the Energy Secretary.

In a letter to Mr Miliband, the committee said the Government must cut CO2 emissions by 81pc by 2035 when compared to the benchmark year of 1990. This would amount to a reduction of 200m tonnes from the current level of 384m tonnes.

Piers Forster, the CCC’s chairman, said persuading British consumers to change their diets would play a key role in achieving such massive cuts.

Mr Forster did not specify how the UK could reduce meat eating but options could include reducing subsidies for livestock, taxing meat products and a clampdown by regulators on advertising.

A Not So Fine Dining Experience

During the pandemic, the dictators assured us that restaurant closures would not be an issue, since the economy would easily “recover” afterwards. Add in the recent hikes in minimum wages and it comes as no surprise that the marginal consumer has evidently reached a very different conclusion.

Late last week, anonymous sources told Bloomberg that TGI Fridays was preparing to file for Chapter 11 bankruptcy and was in talks with lenders who could possible keep the company afloat in the meantime.

In related news, Denny’s is scaling back its operations in accordance with the declining fortunes of its customers.

Denny’s is closing 150 restaurants over the next year, and the 71-year-old diner chain is mulling a major change to its 24/7 operating hours.

Fifty locations are set to close by the end of 2024, while the remaining 100 will shutter in 2025, Denny’s announced in an earnings call Tuesday.

Hardware Headaches

With the marginal consumer now cutting back in sharp contrast to the heady days of the pandemic spending spree, we’re likely to see more of this in the future.

True Value, the hardware retailer based in Chicago, has filed for Chapter 11 bankruptcy and agreed to sell itself for $153 million to Do it Best Corp., the home improvement company based in Fort Wayne, Indiana, according to court filings.

Housing Problems

Micheal Gayed of the Lead-Lag Report interviews Canada’s foremost real estate expert Ron Butler in a recent podcast. Well worth the listen as it covers all the main points about Canadian real estate. In a nutshell, the Canadian housing market might be where the US was in 2008, or maybe even worse.

Juan Valdez Will Be Looking For Work

This will go great with a bowl full of bugs first thing in the morning.

Psy.org- Scientists release the recipe for lab-grown coffee to accelerate creation of new coffee ecosystem

I’m Not Eating Bugs

Sun- Is Bill C-293 Canada’s ‘Vegan Act’?

Under this bill, public health officials could have the authority to close facilities they consider “high risk,” such as meatpacking plants, during pandemics and even “mandate” the consumption of vegetable proteins by Canadians — measures that border on the absurd. It’s hardly surprising that the private member who introduced Bill C-293 is Liberal MP Nathaniel Erskine-Smith, who is known for his vegan lifestyle.

More Dead Dinosaurs

Another one bites the dust. Most SDA readers won’t be shocked.

Half the staff at a news-talk radio station’s newsroom in Kamloops were fired Tuesday.

Around 11 a.m., what was supposed to be the syndicated Mike Smyth Show was replaced with classic rock. The station was broadcasting brief The Canadian Press news updates.

Is The Spending Spree Over?

If the decline in Fedex’s earnings is not an indication that the marginal consumer is tapped out, I don’t know what is.

…Fedex stock tumbled as much as 11% after hours when it cut the top end of its full-year profit outlook and reported quarterly earnings below expectations on softer demand for package deliveries.

The company said that Q1 results were negatively affected by a mix shift, which reduced demand for priority services, increased demand for deferred services, and constrained yield growth. In addition, higher operating expenses and one fewer operating day negatively affected the quarter’s results.

Hat tip: Neil

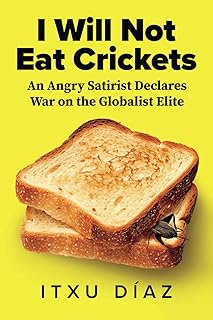

You Will Eat Bugs, Live In A Pod, Own Nothing And You Will Like It

I Will Not Eat Crickets – A book review by Rick McGinnis.

I Will Not Eat Crickets – A book review by Rick McGinnis.

There are many recent books that share the same targets as Díaz without his satirical tone, but you have to understand up front that his target—globalism—has had a sea change in its definition and its opponents in the last generation. Back when free trade was an article of conservative political faith, the globalist worldview was embraced by people who wanted to lower costs, broaden supply chains, and – as they sold it in a best-case scenario – export economic prosperity from first to third worlds as they offshored labour.

Like most ideal scenarios, it didn’t quite work out as planned.

Economic Headwinds

So much for “normalizing” interest rates. When even the mainstream financial media is picking up on the idea that interest rates are not only going to fall, but fall quickly, you just know that a recession is baked in the cake.

Billionaire John Paulson said the Federal Reserve has waited too long to cut interest rates and expects the central bank to lower them in the months ahead.

By the end of next year, “my best guesstimate would be around 3%, perhaps 2.5%” for the federal funds rate, Paulson, 68, said in an interview on Bloomberg Television.

Gradually, Then Suddenly

The Assault On Speech Goes Global

Walter Kirn and [Matt Taibbi] discuss the detention of Telegram founder Pavel Durov and raids of figures like Dimitri Simes, which has leaders of independent platforms in a panic

Y2Kyoto: State Of Anorexia Envirosa

In its monthly update on energy trends, Statistics Canada reported this week that this year, for the first time ever, Canada has become a net importer of electricity. The switchover in our electricity trade balance reveals the shortcomings of an energy strategy that now emphasizes decarbonization over energy security, leaving customers vulnerable to supply shortfalls and higher prices.

“Sales have been weaker than it expected”

Telegraph- Heat pumps could bring the German economy to its knees

Governments keep making the same mistake, of backing ‘winners’ long before they’ve proven themselves in the market

The Decline And Fall Of The American Empire

Why would the head of the Department Homeland Security want to destroy the United States? (Full interview here.)