“India’s worst-case scenario now a reality.“

Dear China,

So funny, you’ll cry.

You have not replied to my last 47 attempts to contact you regarding the 700 billion Euro loan we discussed. I have tried to contact you by phone, via Federal Express, various Ambassadors, a US destroyer with a party of EU diplomats concealed on the aft deck, and E-cards with pictures of big-eyed European Finance Ministers holding their hands out. I am very disappointed in you – I felt that we were developing such a beautiful relationship when you started buying Greek bonds. It is obvious that we have so much in common – you have money and we need money.

(h/t Adrian)

Related – borrowing of industrialised governments has surged beyond $10tr this year and is forecast to grow further in 2012.

It’s Probably Nothing

It’s Probably Nothing

Via Global Strategy Weekly newsletter (sorry, no link);

It’s Probably Nothing

The problem with socialism is that eventually you run out other people’s money. – Margaret Thatcher

What made this conference remarkable was not the presentations, though they were generally quite interesting. The stunning part of the conference was learning – as part of casual conversation during breaks, meals, and other socializing time – how many rich people are planning for the eventual collapse of European society.

Not stagnation. Not gradual decline. Collapse.

Read the whole thing. Via Instapundit

It’s Probably Nothing

The Economist;

|

|

More – An interactive overview of global house prices.

It’s Probably Nothing

(Click for full size) Via EnergyEcon.

Oh Oh. “Regulated” Derivative Markets About To Blow Up?

Dear Clients, Industry Colleagues and Friends of Barnhardt Capital Management,

It is with regret and unflinching moral certainty that I announce that Barnhardt Capital Management has ceased operations. The reason for my decision to pull the plug was excruciatingly simple: I could no longer tell my clients that their monies and positions were safe in the futures and options markets – because they are not. And this goes not just for my clients, but for every futures and options account in the United States. The entire system has been utterly destroyed by the MF Global collapse.

I have learned over the last week that MF Global is almost certainly the mere tip of the iceberg.

It’s Probably Nothing

“As the size of the Fed’s balance sheet ballooned,” continues Mr. Pento, “the dollar amount of capital held at the Fed has remained fairly constant. Today, the Fed has $52.5 billion of capital backing a $2.7 trillion balance sheet.

“Prior to the bursting of the credit bubble, the public was shocked to learn that our biggest investment banks were levered 30-to-1. When asset values fell, those banks were quickly wiped out. But now the Fed is holding many of the same types of assets and is levered 51-to-1! If the value of their portfolio were to fall by just 2%, the Fed itself would be wiped out.”

It’s Probably Nothing

“So America has a President Goldman Sachs, Italy has a Prime Minister Goldman Sachs, and the European Central Bank will now be headed by a former Goldman Sachs banker.”

It’s Probably Nothing

Well, now. After staring at this thing in dismay and sorrow I started thinking about Swedish movies. You know, the kind of thing where the people are just sitting around staring. Every once in a while they utter a word, and just when you are about to die of boredom they get up and look at a clock or break a mirror or something like that. It is supposed to be deeply symbolic. I don’t know what happens next because I never last that long.

It’s Probably Nothing

Data released showed that 5.3 times as many municipal bonds were credit downgraded over the three last months than were upgraded.

The Decline And Fall Of The American Empire

Events subsequent to the Senate lame-duck vote on the New START Treaty only serve to reinforce concerns given short shrift at the time – notably, with respect to the inadvisability of cutting and otherwise allowing the further atrophying of the U.S. nuclear deterrent, at a time when every other nuclear power, including Russia, is modernizing its arsenal.

Who is John Galt?

It’s Probably Nothing

Dollar Yen Plummets To New Post World War 2 Low

It’s Probably Nothing

According to Bloomberg and The Hill, Frank plans to submit a bill that would remove the votes of the five regional Federal Reserve presidents from the 12-member Federal Open Markets Committee (FOMC), which sets interest rates, and replace them with five appointees that would be nominated by the President and confirmed by the Senate.

Via Maxed Out Mama, who shares a preview. But read the whole thing – it’s worth signing up for.

It’s Probably Nothing

In Long Beach, the second-busiest container port by volume, August imports fell by 14.2 percent from August 2010. While the port has not yet released September volumes, a spokesman, Art Wong, said it expected about a 15 percent drop from September 2010.

The reports from the remaining container ports in the top five were equally gloomy. In New York-New Jersey, the number of incoming containers in August was about flat with last year. In Savannah, Ga., imports in August fell by 4 percent. Oakland reported that August imports were down 0.9 percent from a year earlier. And Los Angeles, the nation’s highest-volume container port, counted 5.75 percent fewer containers in August than a year earlier.

It’s Probably Nothing

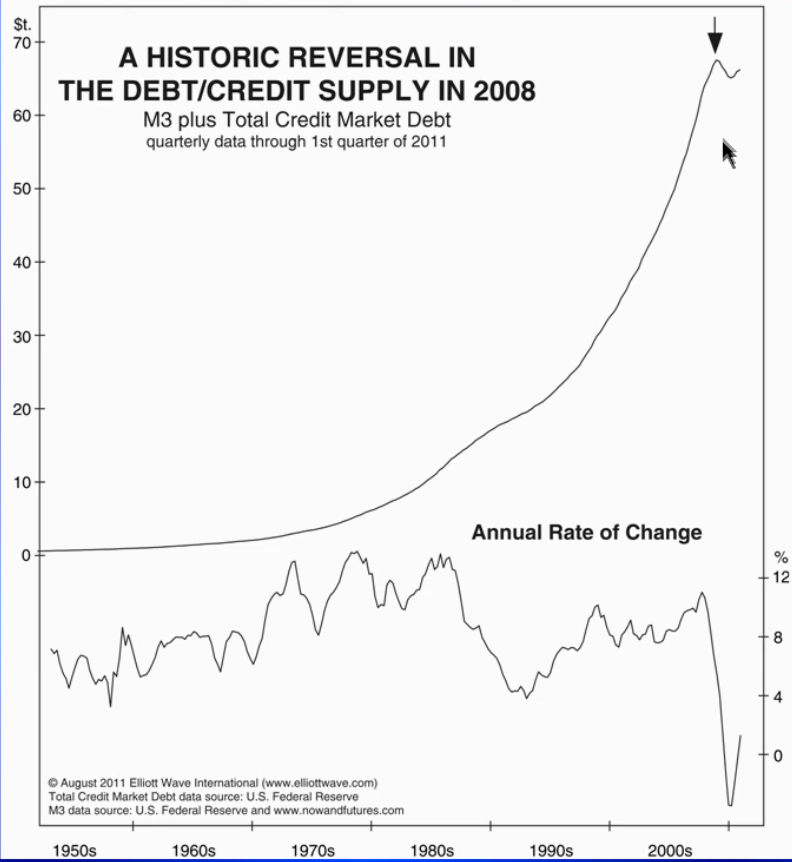

What is the problem behind the Markets/Economy? The problem is Debt began to implode in 2008. As you can see on this first chart below, debt has been growing constantly since the 1930’s, it got into a parabolic rise in the 1990’s and 2000’s and all these new dollars in terms of IOU’s are what supported the Real Estate Blowoff of ’06, the Tech Bubble ’00, and the Stock Boom in general of ’07.

That Debt/Credit supply reversed in 2008, had a slight bounce during market/economic recovery from 08′. But this trend is exhausted….

..more charts HERE

It’s Probably Nothing

No charges were filed against the Muslim who tried to break into the cockpit of American Airlines flight out of New York. If he were Christian or Jew, he’d be behind bars. More sharia. – Pamela Geller Atlas Shrugged

Saudi passenger disrupts flight bound for Indianapolis

INDIANAPOLIS – Federal authorities are probing the actions of a Saudi Arabian man who tried to get into the cockpit of an American Airlines flight to here.

Indianapolis Airport police said Abdulaziz Mubarak Alshammari, 20, was pulled away from the cabin door by another passenger a half hour before Flight 1936 from New York to Indianapolis International Airport landed at about 10 p.m. Wednesday.

Alshammari, who said he is a student at the University of Indianapolis, appeared confused when flight attendants and police questioned him, according to a police report. Investigators photocopied a note Alshammari wrote in Arabic while on the plane.

Scott Hall, a spokesman for the University of Indianapolis, said the school has no record of Alshammari being a student there.

No charges were filed.

It’s Probably Nothing

Retirement programs for former federal workers — civilian and military — are growing so fast they now face a multitrillion-dollar shortfall nearly as big as Social Security’s, a USA TODAY analysis shows.

The federal government hasn’t set aside money or created a revenue source similar to Social Security’s payroll tax to help pay for the benefits, so the retirement costs must be paid every year through taxes and borrowing.

But read the whole thing.