Tell us about your industry/personal observations in the comments, I’ll update the post accordingly.

Dennis (Winnipeg): A neighbor is building a new house. Last fall he priced out rebar for the basement at $9000. This spring he paid $19,000 for the same rebar. His total cost for the house will be $475 per square foot. Another neighbor is trying to price out a steel Zipperloc quonset for storing farm machinery. The dealer will not give him a firm quote as they have no inventory due to just-in-time ordering and steel prices are changing daily

Kenji: I bought a small sleeve of Arrow T-50 staples (for my tack hammer stapler) at my local Ace Hardware yesterday … $14.99. I was stunned.

Hudson: Built a raised cedar planter for $250 last year. Just over $600 for another when I checked last week.

Buddy: 3/4″ 4X8 plywood is $100.00. That’s 3 bucks a square foot! Homo Depot will only sell 32 sheets at a time instead of the normal 40.

Joe Blow: Tell us about your industry/personal observations in the comments: Sure. My salary: +0%

$2 for 4 carrots

Pretty sure there’s something going on… my last Costco bill was $700

Bet you stayed in the building shopping and eating. Now you know why it’s 700 bucks.

Not that my wife and I, don’t have the same issue too.

(-:

Fiat currency losing its purchasing power.

Soy +72% OMG! (Oh My Gaia!)

How on earth am I going to keep my estrogen levels up now?

Stick a 50 cent carrot up your ass.

Thanks for the “tip”

+++++/\ Buddy.

Fk’ing hilarious…!!!

As to cost increases: 1 ea 2 X 4″ X 96″ $ 8.61. Homie depot

I’d be more worried about where you’re going to get your next hamburger or bacon tomato sandwich given most soy is used for animal feed.

Gasoline took another CA$0.10/litre jump this week.

The only consolation is that there is no place to go to. Will cost more to run my lawn mower than my car.

Damn, I was planning on making a fighter jet on my front lawn out of plywood and sell it to the US Military.

I had heard their F35 is a dud and only good for a lawn ornament.

I’ve seen butter above 7 bucks a pound and paid 5 bucks for 5 pounds of Yukon Gold potatoes.

I’d say at least a 50% increase since last lockdown.

Yukon gold potatoes direct from the grower $20/50lbs. The price inflation doesn’t make it all the way to the farm

Grinding us between the millstones of high taxes and high inflation. 40% capital gains taxes … 270% lumber price increase … it’s what Socialists do. This is exactly how you destroy capitalist economies.

We’ve cut way back on our Palladium and Platinum consumption, preferring to source local, homegrown and organic substitutes. It’s made all the difference!

Slow clap…

^this

Bought a few 2X2 X 8ft for my for my target stand.

Expected to pay maybe $2, they were $6.50 ea.

Seeing food prices going up a lot.

That is cheap, where you got them?

But gold remains flat. Considering buying a big chunk of land and hunkiering down.

It’s a great time to be a sheep farmer in Canada. Lambs are bringing in record high prices at market, reflected by the $38 lamb roast I declined to buy over Easter. Buy now folks, it’s not getting any better.

A neighbor is building a new house. Last fall he priced out rebar for the basement at $9000. This spring he paid $19,000 for the same rebar. His total cost for the house will be $475 per square foot.

Another neighbor is trying to price out a steel Zipperloc quonset for storing farm machinery. The dealer will not give him a firm quote as they have no inventory due to just-in-time ordering and steel prices are changing daily.

What city ?

Just outside of Winnipeg.

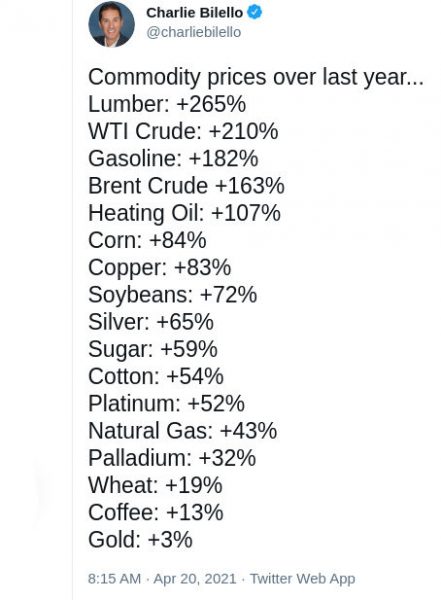

One lesson from the chart – BUY GOLD. Such brutal financial irresponsibility is driving inflation like we haven’t seen in 40 years. Governments can only pay back the debt with diluted currency. And lock in that mortgage at 10 years. And buy real estate.

I’ve been a gold bug all my life. I have gold in my stash I paid 300 an ounce for. The problem with gold long term is there is no income from it. I would have to sell my gold to get my money back.

If you want to make money in gold short term, it’s easier to buy something like ZGD, which is a gold mining index fund. The price fluctuation in the miners is substantially greater that in the metal. Gold took a dip about a month ago, so I bought a bunch. It’s up 15 percent in that time. I suspect I’ll sell out when gold pushes 2000, because it will probably drop at that point, then if it does I’ll buy back in.

With any luck I won’t need my bullion stash, and when I die my kids can use it for a down payment on a house.

The Gates plan … Global agenda population control and culling out the herd. He is controlling the food. He has purchased vast amounts of farming land around the world. Our dollar is failing and it’s all part of the One World Order, a continuation of communist Nazi Germany

“…a Continuation of NAZI Germany”

QUITE Right.

The Same Globalist FILTH as then: Rockefellers, Rothschilds, Siemaans, Krupp – the list is vast….add in GATES, Soros among others

I bought a small sleeve of Arrow T-50 staples (for my tack hammer stapler) at my local Ace Hardware yesterday … $14.99

I was stunned.

Stainless steel, pack of 1,000? They’ve always been around that price, maybe a buck or two less a few years ago.

Maybe you meant to buy Arrow’s cheaper non-stainless steel line, which (still) run around $5 a sleeve (black and yellow packaging)?

Built a raised cedar planter for $250 last year. Just over $600 for another when I checked last week. Just about everything up at the grocery store. Acreages just outside Edmonton in my area are on the market for only a few days and then sold. One down the road didn’t last the day.

Was looking at a manufactured home – up over $40,000 last year. Went from $143,000 and change to $185,000 and being told that there will be more substantial increases on the way.

Yup – inflation is low according to our “betters.”

OUCH.

We bought a (plastic) one and paid $300.

By the way, it’s junk too. (China)

But but but inflation isn’t even 2%! According to Stats Can…..

The government lies. Please make a note of it.

On their carefully select “basket” of goods…

Lies of omission are still lies

I’m guessing double-digit can’t be avoided.

Juthtin Weirdeau, Dummy Freeland and Tout le Gang need to wear this like a farm field wears liquid manure.

Demand increases are still coming/growing/expanding so shortages will as well.

“Reading out the figures in a shrill, rapid voice, he proved to them in detail that they had more oats, more hay, more turnips than they had had in Jones’s day, that they worked shorter hours, that their drinking water was of better quality, that they lived longer, that a larger proportion of their young ones survived infancy, and that they had more straw in their stalls and suffered less from fleas. The animals believed every word of it. “

Wait until the new carbon taxes kick in to make Blackie look good on the world stage. Transportation costs will increase the cost of goods even more. Course we will be too busy worrying about heating our homes.

Nah OJ, We’ll be living in tents and burning our homes to keep warm!

Coffee, sugar, wheat and gold are just starting.

Start prepping kids, our currency will be worthless this time next year if not sooner.

In a vacuum, true.

However, since Cho Xiden’s Amerikkka is going down the same path of economic destruction, in an odd circumstance, the impact is lessened to Canada due to the intertwined economy.

If the US dollar ever lost reserve status, Can Ah Duh would be absolutely fcked, self-inflicted wounds by an indifferent, complacent lemming populace, electing idiots to lead the asylum. No different than the US for that matter.

In times of rampant inflation, own hard assets for protection. I’m about to shift some of my own percentages for inflation protection, better late than never

burton, been prepping for years. If you are just starting, you’re probably too late.

Apply the four G principle. Gold, grub, Ground, and Guns!

Commodities are getting more and more expensive, obviously. Less obvious is the rise in cost of our “rights”. Remember that we only have as many rights as we can afford.

Did anyone catch the Governor of the Bank of Canada the other day? All I saw was the last couple of questions but it was rather concerning. The last question was from Bloomberg who referenced a statement the same guy had made last year indicating that we could rest assured that interest rates would stay low for a “long time”. Buddy from Bloomberg asked him for his current outlook in light of those statements. He danced around the question like a liberal in Swan Lake. Lots of talk about good news recovery and inflation targets but sure sidestepped the rate question. (And inflation for that matter)

Tell us about your industry/personal observations in the comments: Sure. My salary: +0% And I’m made to feel lucky I still have a job and a salary. I’m old enough to remember 70 cent gas.

Very true. Same with my company. We’re lucky to have a job. Yeah, right.

Meanwhile, upper management hammers multi-million dollar options contracts with the stock market flying.

“Inflation for thee, but not for me.”

$.24 a GALLON downtown Toronto back in the day.

The value of those items never changed.

What changed is the value of the currency used to import said items.

Fun fact, if the US is devaluing it’s dollar at the same time that Canada is while the Canadian dollar is only worth .75 cents US wouldn’t that have a multiplyer effect?

My company has instituted two price increases for our manufactured assemblies totalling 16-30% so far this year. Commodities have them freaked right out. They always hedge on raw materials, but the contracts eventually expire.

Inflation is underway, everyone. The question is: do we run to gold or Bitcoin?

Gold or Bitcoin?

Sell high, buy low.

Bitcoin is high, gold, in the current timelines, has barely moved compared to everything else. Gold is legal tender, and not taxable, at high purity such as minted coins and bars.

If we ever lost the power grid, as my inner survivalist suggests, Gold won’t vanish into the ether and be useless. The massive gains in Bitcoin are gone, but Gold lags this recent inflationary trend.

Dan BC, You beat me to commenting on gold or bitcoin. You are correct, bitcoin will evaporate once the electricity is turned off. Not much point in having it if you can’t access and use it. Physical Gold and Silver are what I trust.

Gold coins are taxable. Gold bars at 999.9 and higher are not. At least as of 2018.

Duh,borrowing this money so you won’t have to…

Where did I hear that wisdom?

We have watched Zimbabwe,Venezuela implode in real time.

Venezuela is Canada South.

Very same potential..Destroyed by welfare statism.

Voting yourself other peoples wealth internally and printing money to defraud those you do business with externally..

Does not work at an individual level and does not work at a Government level.

But always the same envy ridden,vicious lazy parasites who attempt it.

For they are “smarter” than everyone else.

Funny how it always ends the same way.

Civilized people refuse to do business with corrupt fools and bandits.

The West has an opportunity ,unseen in recent history.

Declaring our Independence from the realm of Justine The Incompetent and using a unit of bitumen as our official unit of trade.

This is the time,we have next to no choice..almost as if fate moves us.

Free ourselves or perish as a people..Decisions decisions.

For Can Ahh Duh cannot be saved.

And has no desire to save itself,for the Freeloaders plan has always been to defraud their creditors,mostly Canadians,and inflate the unit of trade,the dollar,into oblivion.With the stated intent of our children’s children picking up the tab.

So that means Western Canada (where children are still being born,in significant numbers.)

I stress the “Unit of trade” description of the dollar,so many of our educated but idiot chattering class confuse dollars with actual wealth.

Counting the trade units they have amassed as wealth.

As they deliberately impose regulations that restrict and hamper trade.

Trade brings wealth.

Government brings theft and destruction of trade.

Simple facts invisible to the Effete Elites who lust for power.

Trade requires trust.

No one can trust government.

We have 100 years of proof of that statement.

So the rise of government intervention into trade collapses trading..

No rocket science we have all observed this in real time.

Barter is back,for real stuff no matter how hard to exchange has real value.

Eventually we will settle on an agreed upon unit of trade which we can exchange to expedite the trading of real stuff.

Anything will do,as long as those of us trading ,trust the unit to remain uncorrupted.

Unlike our miserable dollar which Stats Canada has lied about for 60 years.

In the 1900s a dollar/day was wealth.

Today $20/hr is poverty..

All down to “We are from the government and we are here to help you”.

3/4″ 4X8 plywood is $100.00. That’s 3 bucks a square foot!

Homo Depot will only sell 32 sheets at a time instead of the normal 40. Why I don’t know.

To prevent evil speculators from making windfall gains.

I’ve noticed that auction sales are bringing huge prices for a lot of items

Building supplies, steel, decent used machinery are very high. In a couple cases, I’ve seen used plywood, or culled lumber going for the same price that you could have bought new,prime quality, just a month ago

Even machinery that could potentially need very expensive repairs is bringing big prices. Feels like a buying frenzy

I was in the Autopac broker to renew my vehicle insurance on Tuesday. Chatter among the employees was no one is coming in to insure new cars these days. Everyone is buying used.

Yet housing here in Calgary is on Steroids.

My Wife works for one of the largest Homebuilders here – 47 Possessions just in May…we are talking Single Family units in the 350 -750 k range.

I’d say oil/natural gas aren’t valid comparisons in this context (it’s my industry). The market prices tanked last year as the world shut down and sheltered-in-place. It would make more sense to compare to two years ago, when the regular, anti-industry effects were the only ones in play.

That said, I’m not sure any of this is valid for the same reasons, but that can be argued at length.

Do you suppose Turdlala and boyfriend Butts will board a midnight flight to destinations unknown, when people wake up to his “budget isnt going to balance itself” wakes everyone up?

Idiot me, investing in gold. Should have bought plywood.

Cost of government is way up too!

Politicians work hard, so they deserve the raise they gave themselves recently. Times are tough, so why should they suffer?

Inflation might be a contributor, but it’s a small one.

Lumber is up because the industry reduced production capacity per public health restrictions, but the construction industry has generally continued to build and everyone’s at home doing extra DYI projects. Prices are expected to drop by half by the end of the year.

Oil is up because it crashed earlier, global economies (esp. China) are starting to rebound now, and countries including the US are increasingly focusing energy policy and supply towards renewables.

Ag commodities are up because of poor domestic harvests in foreign markets (China) and hence increased NA export demand and hence low stockpiles/inventories, plus forecasted strong economic growth, low interest rates, and low inflation in NA and many global markets.

Etc. Etc. Etc.

Maybe you want this to be only about inflation, but it’s not.

So why is it that gov/ private pension COLAs were under 1%? Why is the gov saying that inflation is low?

Because they are either lying, or it is low using the formula they use to calculate inflation. I don’t know what the formula is, but I understand it is not all that realistic for the average person. Also not all price rises are “inflation”. AFAIK inflation is the rise in prices due to the decreased value of money, not the rise in prices due to increased demand and reduced supply. Right now we are suffering from both.

Lead’s up 23% for the year. Good thing I stocked up.

I just looked at Cabela’s. A brick of Federal Champion 22LR is $45.00!

Oh, and add the impact of a $15/hour minimum wage to the mix.

Just a personal observation on purchasing power and how Canadians get pooched on everything we buy. My local Fabricland is selling a Rit Shibori Tie Dye Kit (made in USA), regular price $75, now 50% off. It’s $33.08 at amazon. The identical kit sells for $13.99 USD at Joann just across the border from me, in Buffalo. Plus, I can use my Joann coupon for and additional 30% off.

As a home sewist, I used to cross the border to purchase sewing patterns, fabric, and supplies. Why would I pay $15 + HST for something I can purchase for $1.99 USD? I would come home with over $150 worth of goods that cost me $50. And yes, I understand the economies of scale.

The reason why “Amazon.ca” is listing that product for $33.08 is because it’s actually being sold by a third party seller (“What America Buys”) that’s using Amazon as a platform to jack up prices for unsuspecting consumers.

I have no idea where Fabricland got $75 retail from.

Here’s a comparable indigo shibori style dye kit, also made in the USA, sold by Indigo Books for $20: https://www.chapters.indigo.ca/en-ca/paper/indigo-tie-dye-kit/743772024866-item.html

Sure. Anybody got the five year average on GIS 3/4″ fir plywood?

You’re mean, Kate. That exercise produces one hell of a hockeystick graph … that would even make Mark Steyn a “believer”.

My lumber guy said oriented strand board 4×8 sheeting a $9 a couple years ago. It is now something like $50. Brutal. Note these price increases are massive and we are not fully recovered. It’s the price Canadians pay for getting 1/2 trillion of something for nothing.

https://madisonsreport.com/2020/12/16/historically-high-plywood-prices-comparison-graph/

Did an inspection with a contractor for annual maintenance on a residential property. He referred to lumber as “brown gold”. He expected a 400% increase in lumber prices over last year.

I was in the largest Stihl dealership in Ontario where I buy and service my chain saws and the shelves were almost bare.

They can’t get saws and parts .

The same seems to be appIied to Iabour, as weII. As a former cost anayIst, I priced the Iumber for a shop I wanted buiIt, and had a quote given to me by a IocaI contractor. I shared my numbers with him, and he agreed they were correct. He quoted me an amount using the numbers I had given him, and simpIy added the cost of his crew Iabour and fees and we agreed upon a price. COVID came aIong, and everything was sheIved for the year.

I contacted the same contractor and asked if he couId stiII buiId the shop, and he said he couId; but the price had more than doubIed. I considered this for a moment, and asked why the prices were so much higher than it shouId be. I showed him the same set of figures; with edits for the new costs for Iumber and he said “Prices are higher because of COVID”…and when I reminded him that the cost of materiaIs had gone up; but not the cost of Iabour, he toId me everything had gone up. So apparentIy, an increase in the cost of materiaI, aIso apparentIy means the tradesmen who work on the jobs…..have aIso doubIed their costs for Iabour….because, weII…Covid.

Does anyone eIse remember a time when contractors were NOT crooks? That time ended a Iong time ago apparentIy….

These unethicaI business peopIe are just gouging simpIy because they can; no other reason.

I believe the rise in prices is caused by…well…everything. Carbon tax, supply line difficulties, COVID just because, greed.

Local Home Depot, New price stickers on every piece of wood. 8 foot 2×4 went up 25 cents to 8.45 from last week.

I’m doing some repairs at a church, there was concern about cost, and I don’t blame them, but I told them I’m less expensive than a contractor, plus they won’t spend the time or the attention required to maintain character of the church. It a hundred year old heritage building.

Gary,

You make a good point. And there’s more: a year or so back, the price of oil fell into negative territory, briefly!! In March 2020, gas in Ontario was below $0.70/litre. Gas hadn’t been that cheap since the 90’s!

This is where statistics can be manipulated to mislead. Pick the “right” point and you can make it look like inflation is out of control for oil and its products. In reality, the prices for oil and its related products have more or less returned to where they were at the end of 2019.

Taking all the numbers in the tweet at face value and without context is simplistic.

Similarly, demand for lumber has gone through the roof. People can’t travel, can’t go out for restaurant meals, can’t enjoy live entertainment. Huge numbers of people have shifted those discretionary dollars in their budgets to home improvement projects. It’s supply and demand – perhaps with a dose of price gouging thrown in!!

The economic armageddon that is coming doesn’t need out help in gaming the numbers.

If the minister of finance hadn’t just told me that inflation is running at 1.1%, I would have believed this bs. I think I’m trapped in a nightmare.

Define collapse and you may have a taker.

$100 to SDA.

Peter’s Drive In Calgary.

Banana split $9.00

Yikes!

Peters has always been a little pricey.

Now the city is helping them, down around the corner, out in the street, bring a nickel, stamp yer feet.

https://calgaryherald.com/opinion/columnists/corbella-druh-farrell-sends-hardworking-familys-dreams-up-in-smoke