The oil price has begun 2018 strongly with Brent breaking through $70 / bbl for the first time since December 2014. OPEC+Russia+others’ discipline on production constraint remains high with ~ 1.7 Mbd production withheld from the market. The IEA reports an ~1 Mbpd stock draw in the OECD + China in 4Q 2017. IEA revisions transform the picture in the USA from one of static production to one of strong growth over the last 3 months (this undoes one of the assumptions used in my 2018 oil price forecast).

Oil Production Vital Statistics January 2018

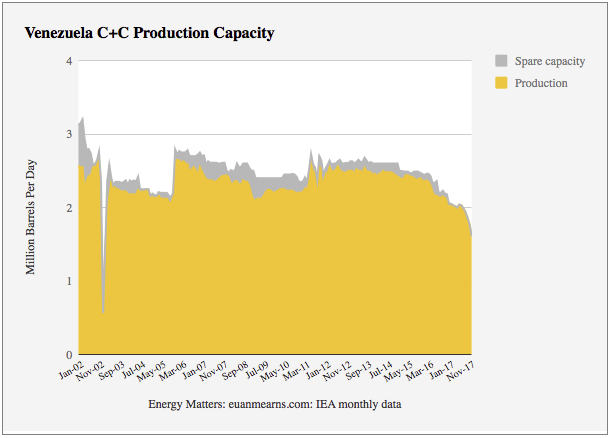

Oil production in Venezuela has fallen 810,000 bpd since December 2014 and describes the slow motion train wreck taking place in that country.

The opec + Russia pullback in production simply means that other producers will ramp up their production to film the void and In time -12-24 months – we will see prices fall back to the 40-50 range.

Outlook Conference in Vancouver last weekend pegged oil at $140 to $170/barrel by 2021. World oil consumption will exceed 100 mil/bpd by 2019.

Never going to get that hogh for any extended period. Typical conference that looks at consumption rates rather than productive capacity.

Yer socialist economics in action.

Been there done that.

Did not learned a damn thing.

Same thing over and over and over.

Alberta and British Columbia, woodoo economics, wishfull thinking economics, academic experience.

Here’s a link to a Reuters story quoting the U.S. EIA Oil Demand forecast for 2018 of nearly 102 mmbbls/d:

https://www.reuters.com/article/us-eia-monthly-demand/u-s-eia-lifts-2018-world-oil-demand-growth-forecast-idUSKBN1EY213

According to the article the demand growth in 2019 would be 1.65 mmbbls/d (roughly the same as the combined OPEC/Russian cuts). Btw that pegs 2018 average demand already at 100 mmbbls/d. And annual demand growth going back to 2009 has exactly averaged out to 1.7 mmbbls/d. It does not look like demand growth, short of a socialist agenda driven economic collapse, is slowing down any time soon. The thing is, exploration for new reserves have been severely hamstrung for about three years and that will cause a shortage because the timelines from discovery to production for most new reserve accumulations is in the 5 to 10 year range. CT is correct – oil will be spiking much higher. Maybe not the $140’s for any length of time but I can see a longer term return to $80+. So long as America doesn’t drink the EU/IPCC Koolaid and shut down its’ industries.

Oops…that first sentence of my above comment should read “for 2019” not 2018. Oh, and the first Captcha word was “Liberta”. Ick.

American oil production has doubled since 2008 from 5 to 10 million bl/day or almost 130 billion USD per year. This has had a major positive impact on the US economy and is negative for Canada, a country that is taking its resource economy for granted.

The Obama wing of the Democrap Party are CHEERING Venezuela’s strategic reduction on dependence upon an OIL saturated economy in favor of a GREEN economy of native crafts. The weaving of floor mats … beekeeping … sewing brightly colored native garb … and bio fuels. Yes, the forward looking NEW economy of Maduro is welcome relief from the Capitalist Pigs who exploit Mother Gaia.

You can add corruption, at the most insidious level, v.v. FISAgate, to the skill set of DeMarxists et al.

I can see a short peak above $100 but the responsiveness of new producers is far better than even a few years ago and their costs have plummeted. Anecdotally I have heard from an ops client that heavy oil in SK is coming in at costs in the low teens.

Speaking of Oil woes, Premier Notley just upped the anti with BC’s watermelon alliance by banning BC Wines from Alberta. Notley stated that the loss of revenue to the Alberta treasury from not building the Trans Mountain expansion alone would amount to a billion and a half per year. That’s more direct revenue than the BC treasury gets from its entire forest industry. Unfortunately, BC’s wine growing region is mostly in Liberal held ridings. Inter-provincial trade wars – only in Canada.

I haven’t bought a bottle of that BC plonk in decades. The ‘industry’ is made up of failed orchardists who couldn’t compete with apples from Washington. They tore out their apple trees and planted grapes. Voila, instant vintners.

The liquor business in AB is private so we might see some blow back but I wouldn’t think it would be on a large scale.

Notley has spent the province into a serious economic position. She needs money and fast. World price for oil is crucial to her election chances. If she can’t convince her ndp brothers in BC to build the pipeline she’ll probably lose her own seat and the socialist experiment will come to an abrupt end.

Gord,

Lower heavy oil cost is a wild card that is possible I won’t argue that. But like MArtin said consumption is growing faster than forecast. Another point made at the Conference was that depletion rates in fracked fields is higher than expected. It is making some producers question the number of barrels recoverable.

Of course the gorilla in the closet is whether there is a ME conflict between the Sunnis and SHites. Saudis vs the Iranians. Turkey has moved into Kurdish Syria threatening Assad and the Iranian hopes of Med Sea access. Are the Turks and Saudis cooperating?

she’ll probably lose her own seat and the socialist experiment will come to an abrupt end

Lose her seat? Not likely. It’s right beside the University of Alberta. ‘Nuff said.

The reserves for frack are huge and lots of it is outside the US. Depletion rates are a red herring.

Yeah your right. Kinda like Ralph Goodale at the University of Regina and Linda Duncan ndp MP at the UofA.

Your right not unlike Linda Duncan and Ralph Goodall. Both lefties living next door in a socialist enclave.

Whoops double post. Should be more careful spelling Rolf Goodale’s name.

The point is as you point out, your a socialist run in a university riding.