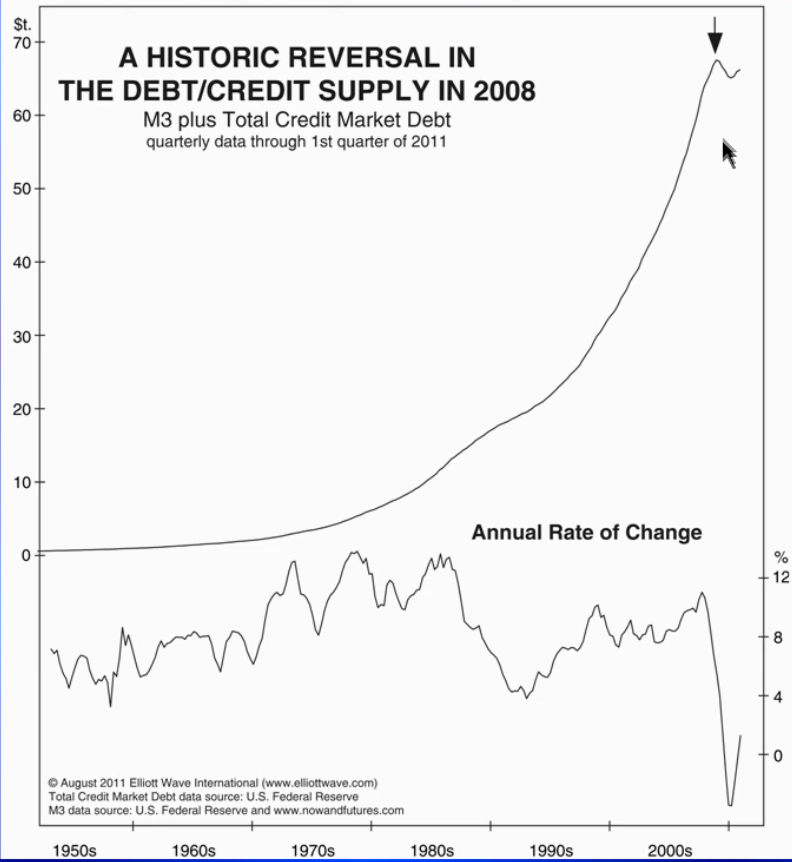

What is the problem behind the Markets/Economy? The problem is Debt began to implode in 2008. As you can see on this first chart below, debt has been growing constantly since the 1930’s, it got into a parabolic rise in the 1990’s and 2000’s and all these new dollars in terms of IOU’s are what supported the Real Estate Blowoff of ’06, the Tech Bubble ’00, and the Stock Boom in general of ’07.

That Debt/Credit supply reversed in 2008, had a slight bounce during market/economic recovery from 08′. But this trend is exhausted….

..more charts HERE

One of the truly scary things is the amount of debt needed to grow GDP. It used to be almost a unity relationship – each new dollar of debt contributed roughly one dollar to GDP. Now it’s considerably higher; about 7 or 8 dollars of debt to grow GDP by a dollar, IIRC.

And the simplest reason I can think of for this is debt used to finance investment in buildings, machines, and infrastructure. Now, much of it simply finances consumption. So, $1.4 trillion borrowed in the US only increased GDP by about $200 million.

It’s the 20th Century Motor Company all over again.

If you remove all government stimulus from the economy you will find that real growth is actually negative. This has masked the fact that we are really in a Global Depression. The Socialist Central Planners for the last 40-50 years have been expanding the role of Government in the EU the US and Canada relentlessly. More Programs more spending more gimmeees. Canada has been no exception. Official Bilingualism total spent Billions result one Unilingual French Province. Endless meaningless spending on EGO Projects and Programs. They have all forgot the intial reason for even having governments. Protection of our borders, our homes and our currency. They have done none of these basic jobs. Taxes now consume more of the average Canadian Family Budget than Food, Clothing and Housing combined. The size of Government is now consuming the people. Taxes have risen 1700% since 1961. Canada at all 3 levels of Government has become a Kleptocracy. A huge shakedown of the taxpayer. Even our Municipal governments have become some of the most corrupt in the country and now use our taxdollars for Ego Projects like Foreign Aid. Meanwhile we are also taxed federally to run a huge Foreign Aid program. The Total Sovereign Debt racked up by years of Liberal Rule Federally and NDP rule Municipally is in the Trillions. Ontario’s Total Sovereign Debt is over 300B, Quebec’s is bigger than Greece’s Debt at 420B. Total of all Provincial Debt is around 1Trillion. Total of Federal Debt plus Deficit is 4-5Trillion. How will this be paid off by only 15-16 million taxpayers. None of our social net is secure. We now pay out 24B a year just for Health and Welfare of new Immigrants. That is more than we spend to assuage the Gaulic Ego of Quebec, keep the Indian Industry going and maintain our Military each year. Year after year. Borrow and spend and borrow again. And the uneducated Liberal Nitwits/Socialists demand more and more. And it seems no one can stop the train. When the Merry Go Round finally stops a lot of people are going to be badly hurt. There Will Be Blood In The Streets.

Which is why they need feel the need to print and why there has been negligible (small outbreaks) of inflation in general.

Large scale credit granting is inflationary and large scale debt repayment is deflationary.

The problem will come when things finally settle out and people start taking on debt again. Then all this money sloshes back in and whoosh you will get inflation.

But this is why I havent been as upset over QE but the government debt needs to be stopped because that isnt doing anyone any good and will hold back the recovery, if and when it comes because of the higher taxes required to pay it off.

But this chart, particularly the rate of change one goes a long way to explaining things. Especially when you consider the US population has continued to grow.

Households are doing the right thing and getting their balance sheets in order, its almost back to pre bubble levels of savings etc. Corps have fixed their balance sheets.

Consumers and businesses are getting ready to resume in the next two years, government just has to get out of the way and stay out of the way….building a massive future tax liability is about blocking the path forward.

“And it seems no one can stop the train” – RFG@10:04

“If something cannot go on forever, it will stop,”

Quote by Herbert Stein senior fellow at the American Enterprise Institute

Your chart and post is well said. All also found this earlier column in Asia Times by Spengler to be persuasive. Unfortunately most US voters seem to ignore our own cupidity in the Ponzi scheme but still desire to punish “bankers” who made out worse. Logic fail; emotion win.

With that in mind I would add to that Herbert Stein quote one word: “If something cannot go on forever, it will stop – disastrously,”

@ RFB at October 13, 2011 10:04 AM

Well put. The great minds we have elected can see the problem but not one has the solution to avoid the train wreck. Stock up on dry food because the end result will be ugly. What happens in the US will follow here. Things will probably start to fall apart within a year and it will make the “dirty thirtees” seem like the good ol’ days.