At the same time that French President Emmanuel Macron is threatening to send troops to Ukraine to fight against Russia, his country is fueling the Russian war effort by purchasing €600 million worth of natural gas from Moscow in the first three months of 2024.

Saskatchewan-based small oil producers leading the charge in land sale

A number of small Saskatchewan oil producers are scooping up land for future drilling.

Every two months Saskatchewan holds a competitive auction for mineral rights for petroleum and natural gas. If a company is interested in getting the Crown mineral rights to a few sections, for instance, they will apply to the government to have that land posted. Then at the next land sale, anyone can bid on it, and whoever bids the highest, wins. So even if a company had does all sorts of exploration and research to secure a certain piece of property, another company can notice what’s been posted on the land sale and outbid them. But whoever bids on it has certain spending obligations within a certain amount of time or they will lose those rights and they can go back up on the auction block again if they are once again posted. This is quite common.

It took me a while to get to this as it came out last week, but that gave me the time to dig deeper and discover that a good chunk of the activity appears to be from Saskatchewan-based junior producers. And that’s pretty exciting news. Yes, there’s still a substantial amount hidden by land agent deals, but seeing the juniors getting in the game like this is a sign of confidence in the industry. And this was posted BEFORE the multilateral announcement. So I wonder what will happen a few months down the road, with postings after the multilateral announcement?

Drill, baby, drill.

To hell with it is “definitely on the table”

Saskatchewan fights back on federal oil and gas emissions cap, Methane 75. Saying “to hell with it” is “definitely on the table,” says minister when asked.

Province invokes Saskatchewan First Act, again, building its case against the federal government’s never-ending smothering greenhouse gas emissions rules, regulations and legislation.

I was up in Saskatoon Monday to cover this important announcement. Saskatchewan’s not going to take it, anymore. Kinda like Twisted Sister. For some reason, I keep referencing that song.

… and the horse you rode in on, Charlie!

The member of parliament who on Feb. 5 introduced one of the most draconian laws against free speech (and that’s saying something in recent years) has decided not to run again in the next election. NDP MP Charlie Angus is calling it quits at the end of this term, after 20 years.

He’s the guy who wanted to ban promotion of fossil fuels, having introduced a private members bill which would have meant every ad on Pipeline Online, for instance, could incur up to a half million dollar fine.

About bloody time

Six years ago, they scratched dirt on TMX. Finally, FINALLY, it is nearing completion, and expected to enter service May 1.

The original pipeline was built over 65 years ago with equipment that largely didn’t even have hydraulics, and absolutely did not have computers, GPS, laser measurement or anything else like that. And they did it in 16 months.

Also:

Brian Zinchuk on Evan Bray Show: Multilateral wells, oil royalties, TMX pipeline, lithium, helium and more

Carbon and lithium

Working through the periodic table:

Lithium in SK, Part 27: Lithium Bank sells Estevan area land to unnamed buyer

Those Lloydminster folks aren’t too happy about the carbon tax.

Nor are a bunch of other people happy about the carbon tax.

And regarding hydrogen and carbon in the form of methane and other natural gas liquids,

Pembina closes Alliance Pipeline deal with Enbridge

As a note, The Alliance Pipeline runs right through Saskatchewan. I started work on it three weeks after my May, 1999 wedding. I was the only guy on my road bore crew of 12 married once! Most were on their second marriage, a few on their third, one I think on his fourth. At that point you walk into a bar, find a woman you don’t like, and give her your house.

In six weeks, it’ll be 25 years for us. So that pipeline project has some meaning for me.

I, For One, Welcome Our New Self-Driving Overlords

It takes massive amounts of energy to power the data center brains of popular artificial intelligence models. That demand is only growing. In 2024, many of Silicon Valley’s largest tech giants and hoards of budding, well-funded startups have (very publically) aligned themselves with climate action–awash with PR about their sustainability goals, their carbon neutral pledges, and their promises to prioritize recycled materials. But as AI’s intensive energy demands become more apparent, it seems like many of those supposed green priorities could be jeopardized.

Y2Kyoto: “This is the hypocrisy that exists in the world”

Good Fracking Luck

It seems that the environmentalist movement has come to the conclusion that there is good fracking and bad fracking. Bad fracking is when we drill a well and extract hydrocarbons. Good fracking is when we expend huge sums to stuff a perfectly harmless gas back down those same holes. It’s a variation on Keynesian economics: wherever we find existing holes, we should pay people to fill them in, even if there is no need to do so. The article goes on to point out all sorts of potential problems with this idea, but then Keynesians will likely argue that remediation efforts will “stimulate” the economy.

With support from the Biden administration and billions of dollars in new subsidies and tax incentives, energy companies and others are planning to capture millions of tons of industrial carbon dioxide emissions and then pipe the climate pollutant for underground storage, part of an effort to reduce the nation’s greenhouse gas pollution. Federal and state regulators are reviewing 69 projects or permits to store CO2 underground, with 24 of those in Louisiana. Nine projects have already been approved while one more, in California, is pending.

For the first time in about two decades, Saskatchewan changes its oil royalties scheme

Are multi-laterals the next big thing in oil? Saskatchewan bets heavy on it with new incentive program. This is the largest change in oil royalties in decades, as the government hopes to incentivize activity and production. It’s a big shift for a government that for its entire 16 years in office said it wasn’t touching a thing when it comes to royalties.

Let me put this into perspective – for the several years Bill Boyd was energy minister, he always gave the same speech, which basically went like this: “The premier has told me to say thank you. Thank you for the jobs, thank you for the taxes, thank you for the royalties and investment. And we’re not touching a thing when it comes to royalties.”

Usually whenever someone mentions royalty changes, it’s with the intention of raising them. This is the opposite, providing a royalty incentive – NOT a holiday – to get more activity and production going.

Hiring young people today is different

Brian Crossman writes about hiring young people in the oilpatch. There’s different expectations today. But really, this applies to all sectors, methinks.

A while back he wrote this column about work ethic, which is the best I’ve seen. I frequently quote it to my own kids, one of whom is in the trades and one will be going into the trades.

“The same architects of our insane energy policy… are also the architects of our military strategy.”

I believe I’ve mentioned this.

The team riffs with Doomberg, a renowned energy analyst, to discuss a range of issues from the global energy landscape to geopolitical tensions and the changing nature of warfare. The conversation also delves into the intricacies of the global natural gas market, the impact of sanctions on Russia, and the potential future of nuclear energy.

Doomberg is a good, though pricey Substack to subscribe to. I wish more of his material was open to free viewing.

Everything energy in 2024 Sask budget

Saskatchewan Budget 2024: Everything energy in the 2024 Saskatchewan budget. Details on Multi-lateral Well Program released #oilandgas

What’s in a name?

BREAKING: Crescent Point Energy to change name to Veren Inc.. It appears to be one more step in the company’s transition from a Saskatchewan focused company to an Alberta focused company.

Crescent Point was STRONGLY associated with the Saskatchewan oilpatch. Now, less and less every day.

Will a First Nation-owned pipeline be without protests and opposition?

Can’t imagine why oil shippers demand explanation from Trans Mountain for pipeline cost overruns, can you?

B.C. First Nation and Western LNG partner to purchase natural gas pipeline project. Can they succeed in bringing a major pipeline in on time and on budget, or will they face the same perils as Trans Mountain (above) and Coastal GasLink? Will other First Nations do all they can to halt it, like GasLink? Will they destroy equipment and raid camps?

US Bureau of Land Management accepts bids for the sale of Federal Helium System. FYI the US Govt getting out of #helium is what’s driving Saskatchewan’s burgeoning industry

Hey, about that pipeline?

Brian Zinchuk: If Poilievre wins a massive majority, can we PLEASE build the Energy East Pipeline?

(I’m fairly certain Premier Moe is tired about me asking about this. I was still talking about it two years ago, which was four years after it was supposed to have been completed. But it’s worth a shot.)

UPDATE: It appears Premier Scott Moe agrees:

— Scott Moe (@PremierScottMoe) March 14, 2024

About those multi-lateral wells … and the Alberta grid

Saturn Oil & Gas has joined the multi-lateral bandwagon, having drilled two open hole multi-lateral wells that the Government of Saskatchewan announced an incentive for yesterday (shared yesterday)

I’ve been saying for over a year the Government of Saskatchewan needs to do something to increase drilling numbers. I’m wondering if this is it?

Also: Alberta’s shaking up its electrical grid by 2027. And in a related story, new rules for power generators in Alberta

Drill, baby, drill. New drilling incentive in Saskatchewan

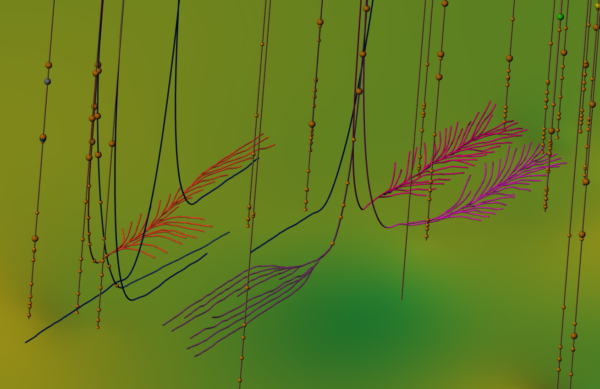

On Monday, Saskatchewan announced a new comprehensive program to attract investment to the province. One of the items is a new program to incentive multi-lateral wells. That’s a well that looks like a herringbone or spiderweb, with lots of legs and increased production.

The question I will be asking soon is if companies are already doing this, why do we need an incentive? Are we leaving money on the table, or is there an expectation of a lot more returns?

Pipeline chicken or the egg?

Pipeline capacity gets restrained, slowing growth in oil production. Pipelines get built (Enbridge Line 3 replacement, Trans Mountain Expansion, eventually) allowing for oil production to grow. Oil production will soon grow to use up all that extra capacity, and production growth will be restrained, again.

So then what? I’m not aware of ANY major new export pipelines projects being considered. After Northern Gateway, Keystone XL and Energy East being canned, who would? And after the federal government proved you could go 6x, maybe closer to 7x over budget building a pipeline they way they want it built, what idiot will try again?

The alternative will have to be crude-by-rail. Oh, lovely.

(That pipeline photos is of a tiny gathering pipeline near Estevan, not a mammoth transmission line.)

As for another fan (NOT) of crude by rail, Quick Dick McDick hauled canola recently. And sang about it. Seriously.

Reject Net Zero by 2050, says Sask United

Several commenters on SDA frequently point out if you accept the premise of your opponent’s argument, you’ve already lost. Looks like that’s what the Saskatchewan United Party is saying here.

Saskatchewan United Party calls on Sask Party government to reject Net Zero by 2050 policy. Leader Nadine Wilson says the Sask Party government seeks to shut down coal and natural gas for wind and solar, gets punted from assembly for calling government liars.

NDP calls for break on fuel tax, finance minister says it would be temporary

Wind peters out in Alberta, yet again, on Wednesday

Op-Ed: Kaase Gbakon: A (Hungry?) Tiger in Your Tank: Part 2